New payment plan without a card

Instant Loan

Now you can make your wishes come true and cover all your home needs even if you don’t have enough cash.

You can apply either at the designated areas in IKEA stores or during your purchases at the IKEA e-shop by selecting "Instant Loan" as payment method.

No card |

Instant approval |

13.9% rate |

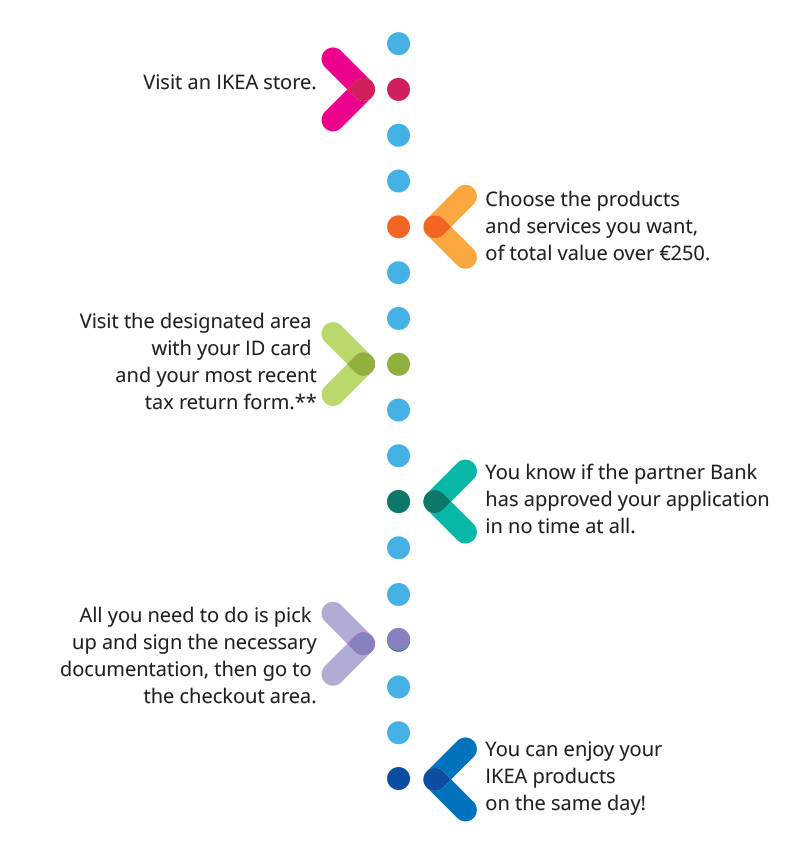

A step-by-step guide to the payment plan without a card

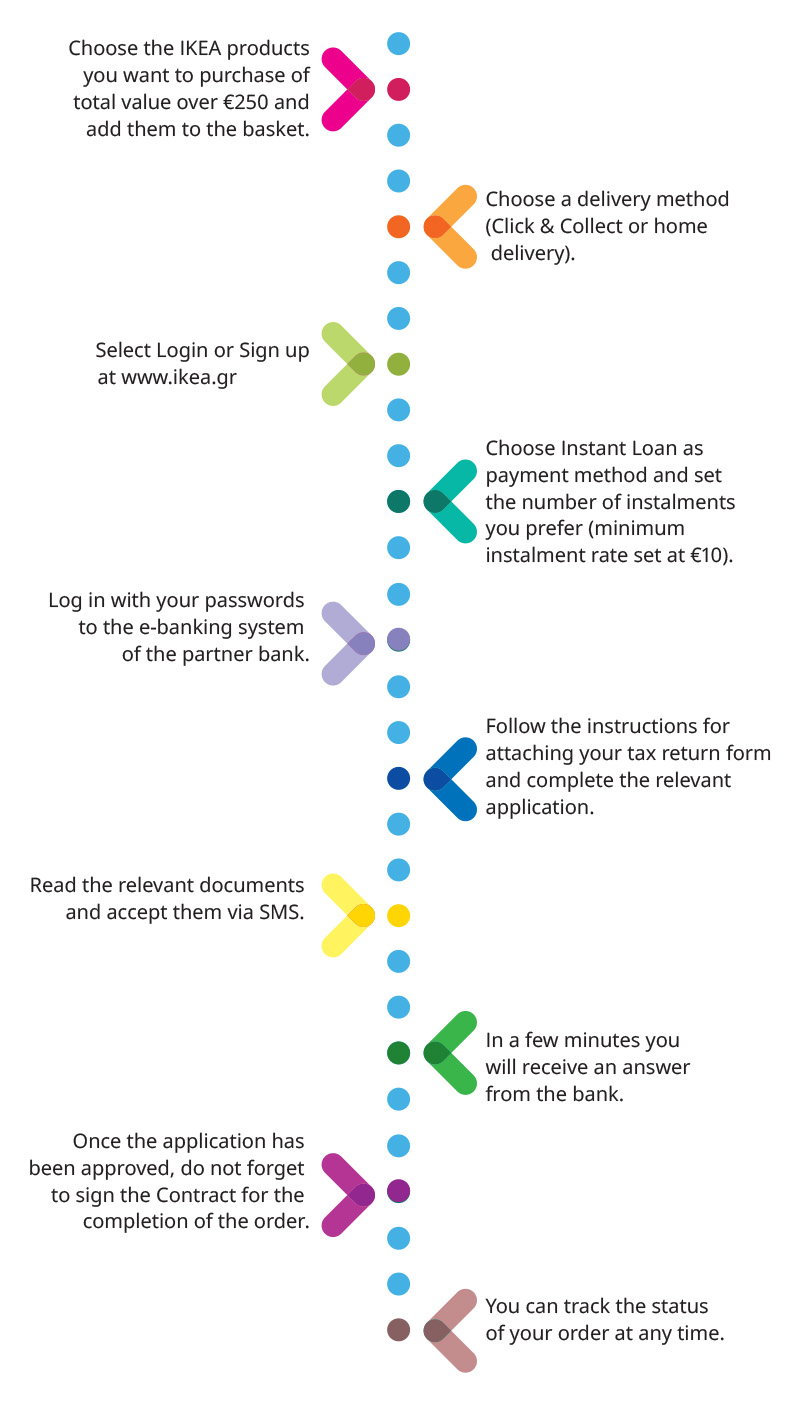

A step by step guide to the Instant Loan payment plan for the IKEA e-shop

What is the payment plan without a card?

What is the payment plan without a card?

- It is a loan you can take out from a collaborating bank and it is subject to the institution’s approval.

- It covers all furniture, home equipment and services purchases paid at IKEA*.

- Loan applications can be made either at IKEA stores or the IKEA e-shop.

- The loan may be applied only when there is a valid proof of purchase. Individuals can take out a loan using a retail receipt and invoices apply exclusively to freelancers or independent business owners (natural persons).

- For purchases from IKEA stores using a retail receipt, the loan can range between €250 and €15.000 and for purchases from the IKEA e-shop between €250 and €6.000, depending on the purchase you wish to make.

- For purchases using an invoice the loan can range from €250 to €3.000 depending on the purchase you wish to make.

- 13.9% fixed rate applies (including contribution under Law 128/75, today at 0.60%) which does not change throughout the duration of the loan.

- The loan must be paid back over a period of 6 to 48 months.

- To take out a loan, you will need your ID card and the latest tax return form.**

- Once the loan has been approved, you will need to sign the relevant contract to proceed with your purchases.

How long will it take for a loan to get approval?

How long will it take for a loan to get approval?

The collaborating bank will grant you a loan after evaluating your application in accordance with its applicable credit policy and provided that the credit requirements are met.

For loans up to €2,000 you can get approval within 3 min. during opening times and for loans over €2,000 in 20 min.

If you apply during weekends, public holidays or after 19:30 pm, you will get a reply from the Bank on the following working day.

Where can you pay back the loan

Where can you pay back the loan

You can pay back the loan at the collaborating bank branches or via e-banking.

Terms & Conditions:

• ** For loans over €2,000 a public utility bill must be provided and the purchase must include furniture.

• The delivery and/or invoicing details should be identical to those of the loan applicant. Otherwise it is not possible to purchase with this payment method.

• Individuals can take out a loan using a retail receipt and invoices apply exclusively for freelancers or indipendent business owners (natural persons).

• For the loan application, the basic condition is the minimum individual income to be over 7,000 €. Otherwise a guarantor is required.

• If the loan application is successful, there will be a one-off additional charge of €25 to the first installment for administrative and operating expenses.

• The loan will be applied towards a single one-off transaction.

• The loan does not cover purchases at the IKEA Restaurant, the IKEA Swedish Food Market or the IKEA Bistro. The loan does not cover the purchase of gift cards.

• The overall Annual Percentage rate (APR) is 16.4%. Example: The aforementioned APR applies to €1,000 and payment over 48 monthly installments.

For more information, visit the designated area from 10:00 am to 20:00 pm, Monday to Friday and until 19:00 pm on Saturday.

Note: For Sundays, the designated area will be open from 11:00 am to 19:00 pm.

For bank holidays and Sundays opening hours, go to “Stores” at www.IKEA.gr or contact us.

* For your convenience regarding the Loan at the IKEA Pick Up & Order Points and at the IKEA Piraeus store, please contact the store you are interested in via phone call.

Contact

IKEA Service Line:

800 111 4000 (for landline calls) - Free of charge.

216 8083400 (for international or mobile phone calls) - Charges according to the pricing policy of your telecommunication service provider.